Games Workshop – 2015-16 Annual Financials

The annual numbers are out. Take a look at how GW did this past year. Fasten your seatbelts.

This is a very short post with only the breaking news and links. We will dig much deeper into this report in the days ahead.

Games Workshop Annual Report 2015-16 – Press Announcement

Annual Report 2016 (Full Report)

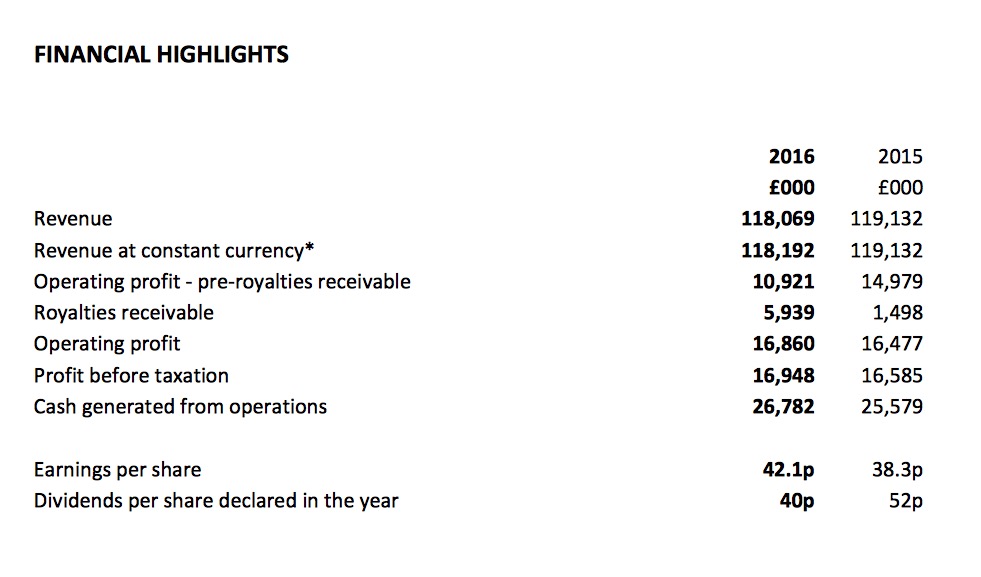

Some top level numbers: (2016 vs 2015)

Revenue: -1%

Operating Profit (pre exceptional items & royalties) -27%

Operating Profit +2%

Earnings per share: +10%

Sales Channel Reports:

Retail: -2%

Trade Sales: +0.001%

Mail-order (web store): -2%

Excerpts from the Non-Executive Chairman:

“The board spent a day recently debating the fact that many proxy votes were cast against it. They were mostly aimed at the remuneration policy (a very fashionable topic these days), the non-executive directors who have served ‘too long’ and, me, the chairman on numerous counts.

As the voting at the AGM itself was unanimously in favour of all resolutions, we would be safe ignoring these proxies, cast as they are, largely, by institutional investors and often by their compliance teams and not the fund managers themselves. Nevertheless they raise two issues: have we explained ourselves properly, and does anyone take any notice if we do? We explain ourselves thoroughly in our corporate governance report (page 17) but some are missed by looking too closely at the detail.”

“The board’s role is to provide entrepreneurial leadership of the company within a framework of prudent and effective controls which enables risk to be assessed and managed1.

I prefer ‘effective’ to ‘entrepreneurial’; nevertheless the board at Games Workshop sees this as its main responsibility. We comply.”

“Our executive directors both have around 20 years service with the company. Their likely replacements have been here a similar length of time (well over 10 years). And, yes, they will be internal appointments. In fact, we see 10 years as the running-in period. I suspect these schemes are needed in businesses that have an eternal merry-go-round of executives who appear and disappear with monotonous regularity. They are not needed at Games Workshop, and I trust they never will be. Furthermore I believe they are fundamentally self-serving and disastrously value destroying. Nothing leaves a sourer taste in the mouth than executives lining their own pockets and claiming it is for the long term good of the business before moving on to their next golden handshake clutching their golden parachute.

At Games Workshop we employ people with integrity. People with integrity always work as hard as they can and always for the good of the business.”

“Over the years we have been exhorted by some to develop our revenue stream by ‘leveraging’ our IP. Using our great imagery we could do all sorts of lucrative and exciting value-enhancing (i.e. take private and re-float) deals. Actually, what they really mean is: do a movie!

We have never NOT done licensing deals, as you can see from the steady stream of royalties we earn; it’s just that we believe we must do them on our terms and not prostitute the business to any and every deal that comes along. If we do a movie (along with the concomitant abandonment of the toy rights6) it will be on terms that do not compromise our business. It isn’t likely.

Long term owners will notice a big increase in royalty income this year. Have we sold out at last? No, it’s just that working closely with the myriad app developers, and being more precise with the terms we offer, we have increased the number of ‘computer’7 games in the market.”

Yearly Review

“We made progress in what was another busy and rewarding year. We started the financial year off with a huge product launch; Warhammer: Age of Sigmar, one of the biggest changes we’ve ever made to one of our core universes. Our design to manufacture was outstanding, over-delivering in terms of original concept art to final manufactured models, producing some of the best models we’ve ever made. The simplified rules, supporting the models for those who like to play, made it much easier to get started. We learnt some valuable lessons during the year on how to deliver product system changes on this scale and as we released more of the range in the second half of the year, we finished the year with sales of Warhammer: Age of Sigmar at a higher rate than Warhammer has enjoyed for several years.

Gross margin was maintained in the period (2016: 68.3%; 2015: 68.9%). We continued with our policy of only increasing the prices of our new releases (approximately 30% of our sales) to reflect the necessary investment in our product offer and the quality we have built into these new releases. The annual impact of this increase on our UK RRP price list is an average increase of 3%.

Costs have increased in the year, mainly as a result of our store opening programme and the full year effect of the depreciation of the investment in our visitor centre which opened in April 2015.

After a disappointing December we carried out a thorough review of our operational plans and, thanks to a great team effort, we bounced back with four out of five months of profitable sales growth”

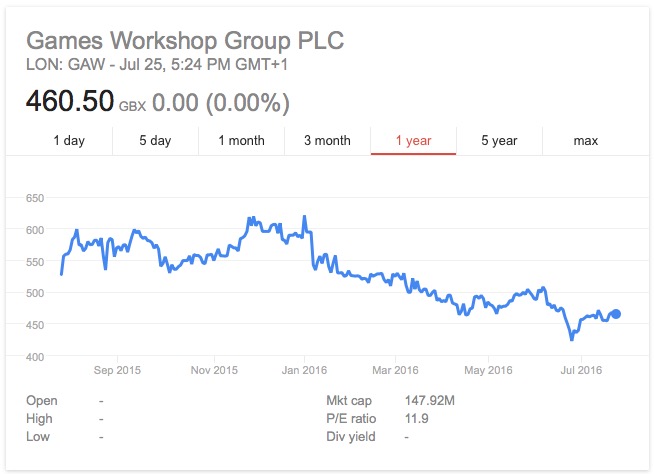

Games Workshop 12 Month Stock Price

View Last Year’s Report For Comparison

~Have your say, and remember, NO CHAIRS – be nice!